|

|

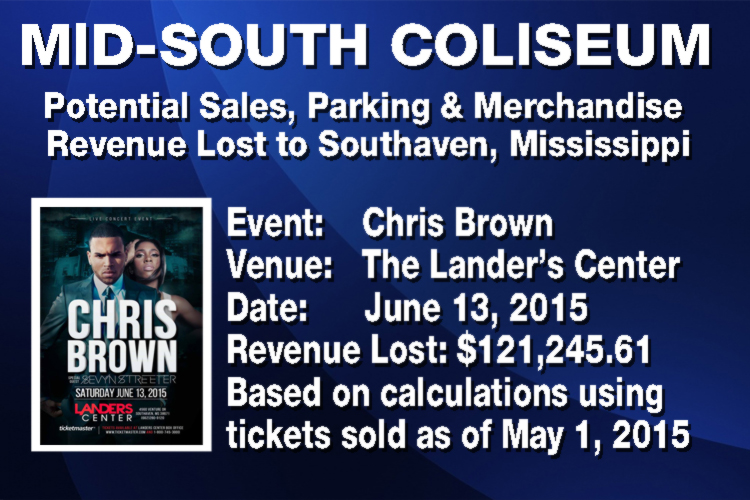

Calculation Notes:

Memphis and the Mid-South is

traditionally a walk-up market. The actual numbers at the

date of performance will be much higher.

Attendance

totals were derived from calculations using Ticketmaster

ticket sales maps for applicable venue.

For total

revenue lost calculations, venue concession sales were not

considered.

The University of Memphis Tiger football program charges

$20 per car for parking at the Fairgrounds. Using an

estimate of four people per car, a parking fee of

$40,000 would be generated for the concert.

An applicable venue normally collects a negotiated

percentage of artist merchandise sold during the

performance. State and local sales taxes are also

charged on the merchandise sold. Percentage collected on

merchandise sold at arena-sized venues generally ranges

from 15% – 35%. The Wall Street Journal has stated that

country star Kenny Chesney generates $8 – $12 per head on

merchandise sold. For the Chris Brown concert, a 25%

merchandise fee and $8 per head sales amount will be used

for calculations.

The venue also charges the concert promoter a rental fee

and in some cases, a variable percentage of the total

gross tickets sold. The average cost of renting a

arena-sized venue is $20,000.

|

|

|

|

|

|

|

Arena |

Total |

Total |

|

|

Calculated |

|

Section |

Seats |

Sold |

Price |

Fees |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Floor 1 |

264 |

264 |

89.50 |

16.25 |

27,918.00 |

|

Floor 2 |

420 |

420 |

89.50 |

16.25 |

44,415.00 |

|

Floor 3 |

420 |

420 |

89.50 |

16.25 |

44,415.00 |

|

Floor 4 |

264 |

242 |

89.50 |

16.25 |

25,591.50 |

|

Floor 5 |

264 |

244 |

89.50 |

16.25 |

25,803.00 |

|

104 |

207

|

207

|

69.50 |

16.25 |

17,750.25 |

|

105 |

376 |

176

|

79.50 |

16.25 |

16,852.00 |

|

106 |

384 |

364 |

79.50 |

16.25 |

34,853.00 |

|

107 |

376 |

75 |

79.50 |

16.25 |

7,181.25 |

|

108 |

237 |

6 |

79.50 |

16.25 |

574.50 |

|

109 |

163 |

4 |

79.50 |

16.25 |

383.00 |

|

110 |

164 |

4 |

79.50 |

16.25 |

383.00 |

|

111 |

203 |

163 |

79.50 |

16.25 |

15,607.25 |

|

112 |

64 |

35 |

79.50 |

16.25 |

3,351.25 |

|

113 |

203 |

6 |

79.50 |

16.25 |

574.50 |

|

114 |

164 |

2 |

79.50 |

16.25 |

191.50 |

|

115 |

163 |

2 |

79.50 |

16.25 |

191.50 |

|

116 |

237 |

11 |

79.50 |

16.25 |

1,053.25 |

|

117 |

376 |

74 |

79.50 |

16.25 |

7,085.50 |

|

118 |

384 |

181 |

79.50 |

16.25 |

17,330.75 |

|

119 |

376 |

221 |

79.50 |

16.25 |

21,160.75 |

|

120 |

207 |

207 |

69.50 |

16.25 |

17,750.25 |

|

205 |

165 |

165 |

69.50 |

16.25 |

14,148.75 |

|

206 |

256 |

256 |

69.50 |

16.25 |

21,952.00 |

|

207 |

165 |

165 |

69.50 |

16.25 |

14,148.75 |

|

208 |

172 |

172 |

69.50 |

16.25 |

14,749.00 |

|

209 |

136 |

136 |

69.50 |

16.25 |

11,662.00 |

|

210 |

122 |

122 |

69.50 |

16.25 |

10,461.50 |

|

211 |

88 |

88 |

69.50 |

16.25 |

7,546.00 |

|

212 |

112 |

112 |

69.50 |

16.25 |

9,604.00 |

|

213 |

88 |

88 |

69.50 |

16.25 |

7,546.00 |

|

214 |

136 |

136 |

69.50 |

16.25 |

11,662.00 |

|

215 |

136 |

136 |

69.50 |

16.25 |

11,662.00 |

|

216 |

169 |

169 |

69.50 |

16.25 |

14,491.75 |

|

217 |

177 |

177 |

69.50 |

16.25 |

15,177.75 |

|

218 |

215 |

215 |

69.50 |

16.25 |

18,436.25 |

|

219 |

177 |

177 |

69.50 |

16.25 |

15,177.75 |

|

|

|

|

|

|

| Totals: |

8,230 |

5,642 |

|

|

528,841.50 |

|

|

|

|

|

|

|

|

|

|

|

|

| Tennessee Sales Tax Lost |

|

|

$48,917.84 |

|

|

|

|

|

|

| Venue Rental |

|

|

|

20,000.00 |

|

|

|

|

|

|

|

Merchandise Percentage |

|

|

11,284.00 |

|

|

|

|

|

|

| Merchandise Sales Tax |

|

|

|

1,043.77 |

|

|

|

|

|

|

| Parking Revenue |

|

|

|

40,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue Lost: |

|

|

|

$121,245.61 |

|

|